Gold just crossed $5,000 for the first time ever.

And honestly? The rally is moving so fast that Wall Street can't keep up. They're scrambling to raise their targets in real-time.

What's Polymarket Saying?

According to the prediction market Polymarket, the crowd is betting big on more upside:

2026 Predictions from the Big Names

Banks and economists are updating their forecasts and calling for more gains:

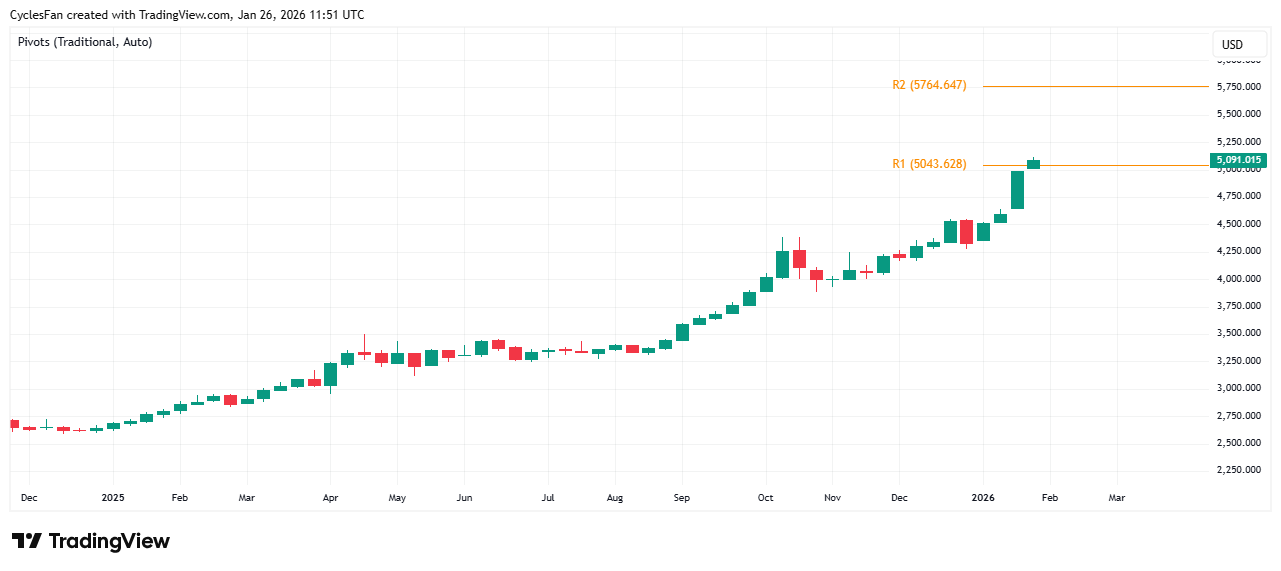

Technical Levels

At these prices, cycles and Fib projections matter most.

Cycles Fan has $5,763 as the 2nd yearly resistance – a level worth watching.

Our Take

High inflation. Oil prices through the roof. Geopolitical chaos everywhere.

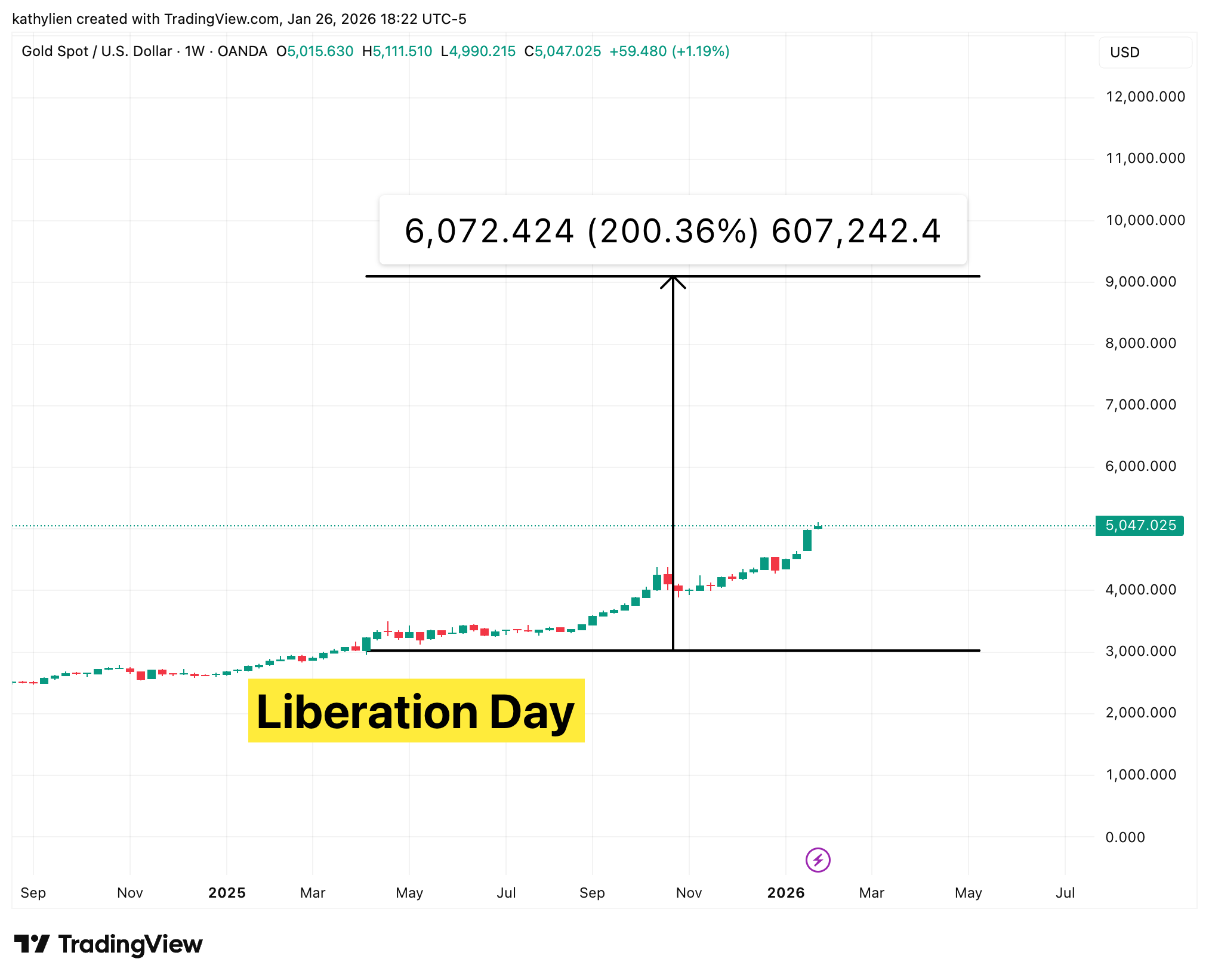

If that sounds familiar to you, back then, gold ripped 200%.

If you apply that same move from Liberation Day levels? You're looking at $9,000 gold. Even a 100% move would put gold at $6,000.

This Isn't Just About Dollar Debasement

Yes, the debasement trade is real. But there's something bigger going on here.

Gold might be telling us a global debt crisis is coming.

Think about it:

More Fed Cuts Ahead

US growth is still beating expectations and the Fed will be cutting rates into strength. That's a problem for the dollar. It means US rates, both nominal and real are falling relative to the rest of the world.

Lower real rates + massive deficits + geopolitical uncertainty = Gold's perfect storm

Yes There Will Be Corrections

As traders, its important to be realistic: Pullbacksare coming.

Gold is up 17% in January. 85% year-over-year. After a move like that, some profit-taking is inevitable. In the 1970s, gold rebounded quickly but not before a 30% pullback

Soask yourself: what would actually break this rally?

None of that is in the cards.

Central banks are still buying. The Fed is still easing. Deficits are still exploding. De-dollarization isn't slowing down.

So when gold pulls back and it will that's not a signal to panic. That's a signal to pay attention.

The structure hasn't changed. The bid is still there.

Corrections? Yes. Trend change? Not without a major shift in the fundamentals.

Ready to Trade Gold?

Whether you’re scalping XAUUSD or trading the bigger macro trend, these are two Forex/CFD prop firms worth considering.

Gold hits $5,500 by June? 81% odds

Gold hits $5,500 by June? 81% odds