Every bull market has a moment where the story sounds perfect.

The economy looks fine. Earnings look stable. Headlines feel reassuring. Pullbacks get bought instantly. And the general belief becomes: this market just doesn’t want to go down.

But markets don’t usually turn when people are scared.

They turn when positioning quietly shifts underneath the surface.

The two charts you’re looking at show exactly that shift.

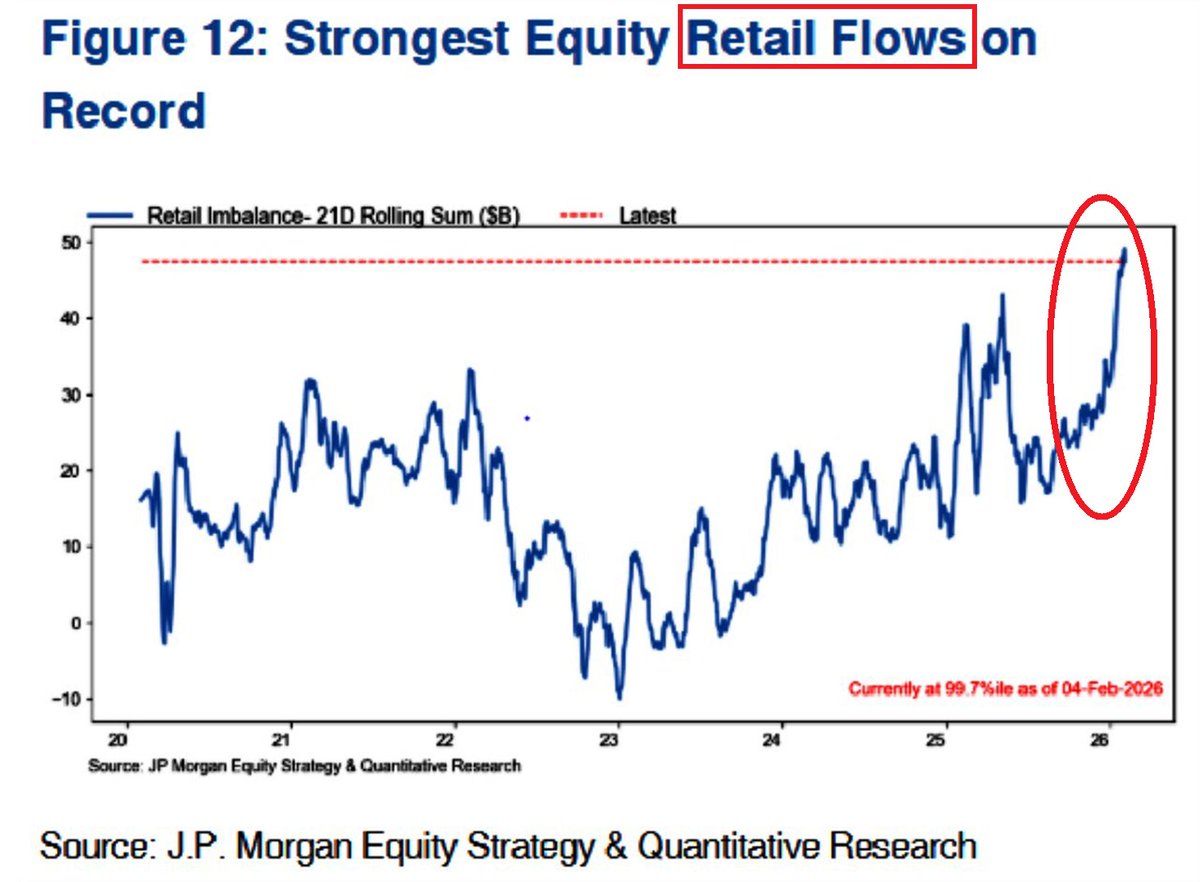

Chart One: Retail Is All-In

The first chart tracks retail equity flows, how aggressively individual investors are buying stocks.

Right now the reading is near the 99th percentile on record.

That means retail participation isn’t just strong.

It is historically extreme.

When investors are pouring money into equities at this pace, it tells you something important about psychology. People are no longer cautious. They are convinced dips are opportunities. The fear of missing out has replaced the fear of loss.

This tends to happen late in cycles.

Retail does not typically lead market turns. Retail reacts to performance. The stronger the rally, the more confident participation becomes. By the time flows reach extreme levels, buyers are not asking whether they should own risk. They are asking how much more they can add.

That is not a timing signal by itself. Markets can stay elevated for a while.

But it tells you the market is becoming dependent on continuous inflows to keep rising. And when the marginal buyer becomes emotional rather than analytical, stability decreases.

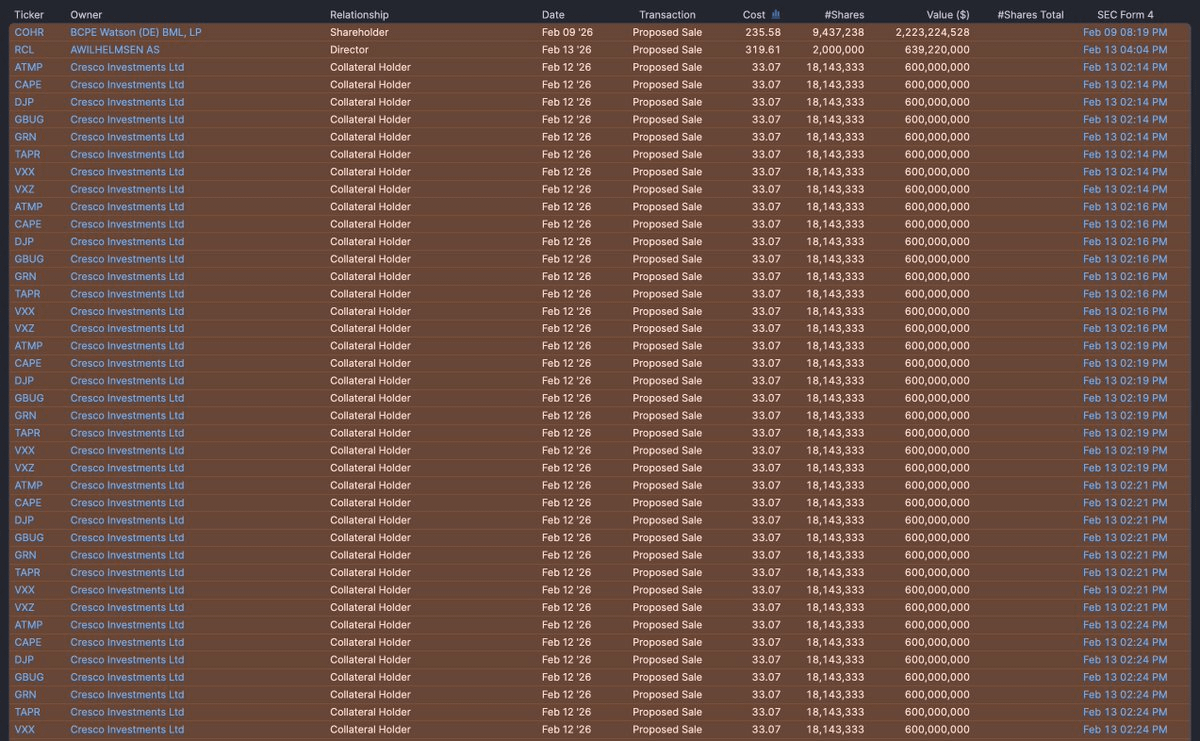

Chart Two: Insiders Are Doing the Opposite

Now look at the second chart, the insider transaction filings.

This is where the story changes.

While retail traders are buying aggressively, corporate insiders are selling across the board. Large shareholders, directors, and collateral holders are filing massive proposed sales, many in the hundreds of millions. The flow is overwhelmingly one sided, distribution not accumulation.

This matters because insiders operate with a different perspective than the public.

They do not trade charts or narratives.

They see order trends, margins, financing conditions, demand softness, inventory buildup months before earnings reports reveal it.

Individually, insider sales mean nothing. Executives sell stock all the time.

But clusters matter.

When selling appears across multiple companies, sectors, and large ownership groups at the same time, it is rarely random. It usually signals a shift from growth expectations toward capital preservation.

In simple terms, the people closest to corporate reality are reducing exposure while the people furthest from it are increasing exposure.

Why the Combination Matters

Neither chart alone is a warning.

Retail buying can support a trend.

Insiders can sell early.

But together, they tell a very specific story about market structure. Ownership is transferring.

Late cycle markets do not collapse because valuations are high.

They weaken because informed money exits and price becomes dependent on sentiment buyers.

Think of it like a relay race.

At healthy stages, institutions carry the baton.

Near peaks, they pass it to the public.

The handoff does not cause an immediate fall. Often the market rises a bit longer. But the foundation changes. Volatility increases, reactions to news become sharper, and liquidity disappears faster during shocks.

Why This Matters for Prop Traders

For prop traders, this information is important because potential turning environments create the most dangerous type of trades, false reversals and premature top or bottom picking.

When positioning becomes extreme, price stops behaving cleanly. The market can continue higher while weakening underneath. Traders begin to see what looks like a perfect reversal pattern, enter early, and get run over as the trend squeezes one more leg. Then, after stops are triggered, the actual turn finally happens.

This is the classic late cycle trap.

The market gives multiple early signals before the real move.

Knowing that insiders are distributing while retail is heavily buying helps frame expectations. Instead of trying to predict the exact top, traders can focus on confirmation. You wait for breaks that hold, not breaks that merely look stretched. You avoid fading strength simply because price feels too high. You stop trying to catch the first turn and instead trade the second move.

Most prop trading drawdowns do not come from being wrong about direction. They come from being early.

Understanding this backdrop helps avoid forcing reversal trades, reduces unnecessary attempts to pick tops and bottoms, and keeps the focus on validated moves rather than anticipated ones.